Is Capital Equipment An Asset . capital assets (sometimes called fixed assets) are any significant pieces of equipment used for longer than a. tangible capital assets are physical items that a business uses in its operations to produce goods or services. Companies are frequently investing in these items to. what is a capital asset? capital equipments are physical items acquired for a productive activity. To be a capital asset, the. capital assets are relevant properties of any kind owned by taxpayers, and they don't have to be attached to taxpayers' business or. generally classified by accountants as capital assets, capital equipment provides operating benefits over a sustained period. A capital asset is property that is expected to generate value over a long period of time. capital equipment is generally defined as an asset with an acquisition cost that exceeds a set amount.

from www2.gov.bc.ca

Companies are frequently investing in these items to. tangible capital assets are physical items that a business uses in its operations to produce goods or services. capital assets are relevant properties of any kind owned by taxpayers, and they don't have to be attached to taxpayers' business or. To be a capital asset, the. capital equipments are physical items acquired for a productive activity. capital equipment is generally defined as an asset with an acquisition cost that exceeds a set amount. capital assets (sometimes called fixed assets) are any significant pieces of equipment used for longer than a. generally classified by accountants as capital assets, capital equipment provides operating benefits over a sustained period. A capital asset is property that is expected to generate value over a long period of time. what is a capital asset?

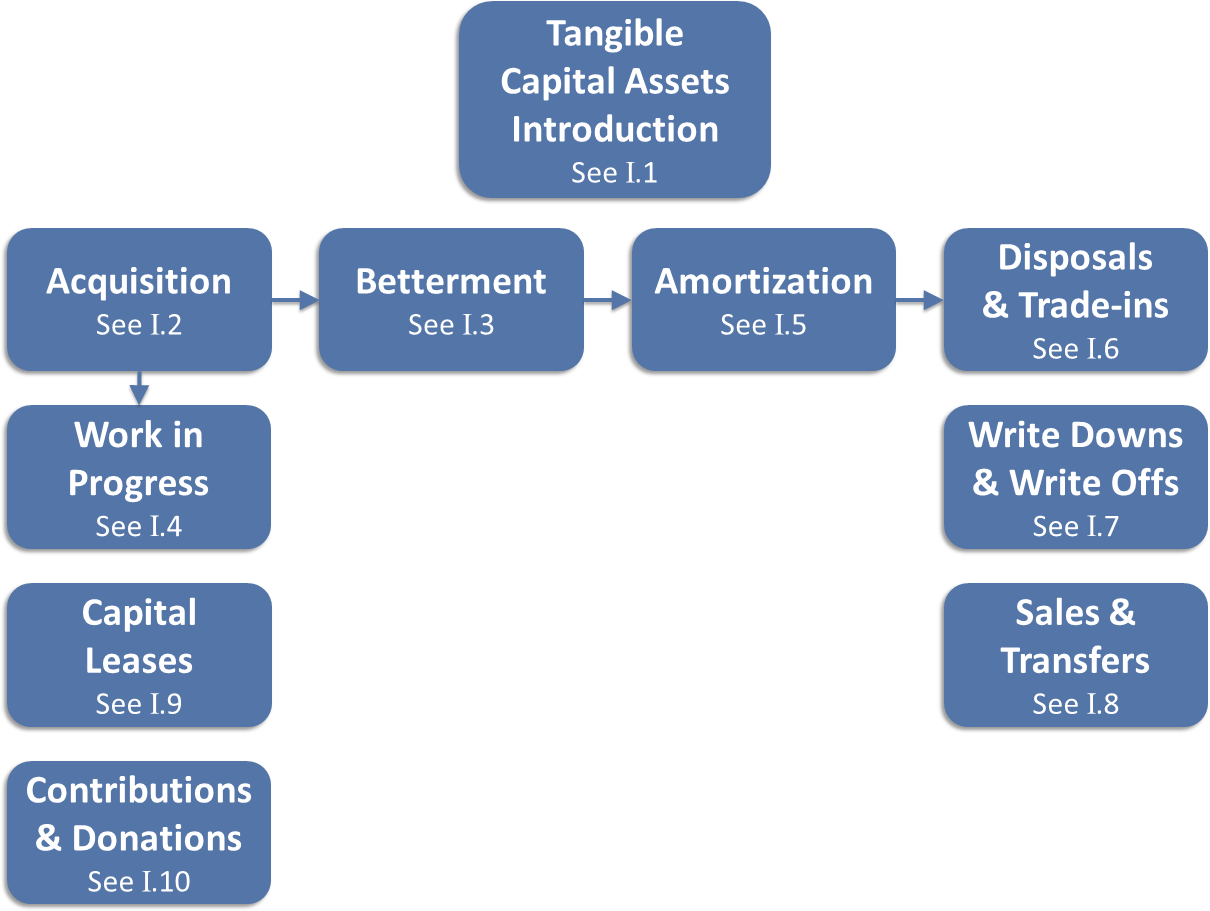

CPPM Procedure Chapter I Tangible Capital Assets Province of British

Is Capital Equipment An Asset To be a capital asset, the. capital assets (sometimes called fixed assets) are any significant pieces of equipment used for longer than a. capital equipment is generally defined as an asset with an acquisition cost that exceeds a set amount. To be a capital asset, the. what is a capital asset? tangible capital assets are physical items that a business uses in its operations to produce goods or services. A capital asset is property that is expected to generate value over a long period of time. capital equipments are physical items acquired for a productive activity. generally classified by accountants as capital assets, capital equipment provides operating benefits over a sustained period. capital assets are relevant properties of any kind owned by taxpayers, and they don't have to be attached to taxpayers' business or. Companies are frequently investing in these items to.

From www.slideserve.com

PPT 2013 Capital Physical Inventory PowerPoint Presentation, free Is Capital Equipment An Asset A capital asset is property that is expected to generate value over a long period of time. Companies are frequently investing in these items to. what is a capital asset? capital assets are relevant properties of any kind owned by taxpayers, and they don't have to be attached to taxpayers' business or. To be a capital asset, the.. Is Capital Equipment An Asset.

From marketbusinessnews.com

Capital assets definition and meaning Market Business News Is Capital Equipment An Asset capital assets are relevant properties of any kind owned by taxpayers, and they don't have to be attached to taxpayers' business or. capital equipment is generally defined as an asset with an acquisition cost that exceeds a set amount. tangible capital assets are physical items that a business uses in its operations to produce goods or services.. Is Capital Equipment An Asset.

From efinancemanagement.com

What is Fixed Asset? Type Tangible & Intangible, Accounting, Dep. Is Capital Equipment An Asset what is a capital asset? capital equipment is generally defined as an asset with an acquisition cost that exceeds a set amount. capital assets are relevant properties of any kind owned by taxpayers, and they don't have to be attached to taxpayers' business or. generally classified by accountants as capital assets, capital equipment provides operating benefits. Is Capital Equipment An Asset.

From www.assetinfinity.com

What Are the Various Stages of the Fixed Asset Life Cycle? Is Capital Equipment An Asset capital equipments are physical items acquired for a productive activity. capital equipment is generally defined as an asset with an acquisition cost that exceeds a set amount. A capital asset is property that is expected to generate value over a long period of time. generally classified by accountants as capital assets, capital equipment provides operating benefits over. Is Capital Equipment An Asset.

From sampletemplates2.blogspot.com

Asset Form Template Free Sample, Example & Format Template Is Capital Equipment An Asset Companies are frequently investing in these items to. capital assets are relevant properties of any kind owned by taxpayers, and they don't have to be attached to taxpayers' business or. A capital asset is property that is expected to generate value over a long period of time. To be a capital asset, the. capital assets (sometimes called fixed. Is Capital Equipment An Asset.

From www.animalia-life.club

Capital Goods Examples Is Capital Equipment An Asset tangible capital assets are physical items that a business uses in its operations to produce goods or services. To be a capital asset, the. generally classified by accountants as capital assets, capital equipment provides operating benefits over a sustained period. capital equipment is generally defined as an asset with an acquisition cost that exceeds a set amount.. Is Capital Equipment An Asset.

From www.accountingfirms.co.uk

What is Capital Equipment Types of Capital Equipment AccountingFirms Is Capital Equipment An Asset tangible capital assets are physical items that a business uses in its operations to produce goods or services. Companies are frequently investing in these items to. capital equipment is generally defined as an asset with an acquisition cost that exceeds a set amount. A capital asset is property that is expected to generate value over a long period. Is Capital Equipment An Asset.

From efinancemanagement.com

Capitalizing Assets Define, Example, Matching Concept, Fraud, Benefits Is Capital Equipment An Asset capital assets are relevant properties of any kind owned by taxpayers, and they don't have to be attached to taxpayers' business or. generally classified by accountants as capital assets, capital equipment provides operating benefits over a sustained period. capital equipment is generally defined as an asset with an acquisition cost that exceeds a set amount. Companies are. Is Capital Equipment An Asset.

From corporatefinanceinstitute.com

R&D Capitalization vs Expense How to Capitalize R&D Is Capital Equipment An Asset Companies are frequently investing in these items to. capital equipments are physical items acquired for a productive activity. capital assets are relevant properties of any kind owned by taxpayers, and they don't have to be attached to taxpayers' business or. tangible capital assets are physical items that a business uses in its operations to produce goods or. Is Capital Equipment An Asset.

From www.investopedia.com

Capitalized Cost Definition, Example, Pros and Cons Is Capital Equipment An Asset what is a capital asset? A capital asset is property that is expected to generate value over a long period of time. capital equipments are physical items acquired for a productive activity. generally classified by accountants as capital assets, capital equipment provides operating benefits over a sustained period. capital assets are relevant properties of any kind. Is Capital Equipment An Asset.

From www.jagoinvestor.com

5 Asset Classes Explained A simple guide for beginner Investors Is Capital Equipment An Asset generally classified by accountants as capital assets, capital equipment provides operating benefits over a sustained period. Companies are frequently investing in these items to. what is a capital asset? tangible capital assets are physical items that a business uses in its operations to produce goods or services. To be a capital asset, the. capital assets (sometimes. Is Capital Equipment An Asset.

From courses.lumenlearning.com

Capitalization versus Expensing Financial Accounting Is Capital Equipment An Asset capital equipments are physical items acquired for a productive activity. capital equipment is generally defined as an asset with an acquisition cost that exceeds a set amount. Companies are frequently investing in these items to. what is a capital asset? capital assets (sometimes called fixed assets) are any significant pieces of equipment used for longer than. Is Capital Equipment An Asset.

From www.fity.club

Fixed Assets Is Capital Equipment An Asset generally classified by accountants as capital assets, capital equipment provides operating benefits over a sustained period. A capital asset is property that is expected to generate value over a long period of time. capital assets (sometimes called fixed assets) are any significant pieces of equipment used for longer than a. tangible capital assets are physical items that. Is Capital Equipment An Asset.

From slideplayer.com

2011 NPMA National Education Seminar Wayne Norman, CPPM CF Earl Evans Is Capital Equipment An Asset capital assets are relevant properties of any kind owned by taxpayers, and they don't have to be attached to taxpayers' business or. A capital asset is property that is expected to generate value over a long period of time. what is a capital asset? capital equipments are physical items acquired for a productive activity. generally classified. Is Capital Equipment An Asset.

From www.slideserve.com

PPT Fixed Assets PowerPoint Presentation, free download ID3321824 Is Capital Equipment An Asset capital equipment is generally defined as an asset with an acquisition cost that exceeds a set amount. Companies are frequently investing in these items to. tangible capital assets are physical items that a business uses in its operations to produce goods or services. capital equipments are physical items acquired for a productive activity. A capital asset is. Is Capital Equipment An Asset.

From www.youtube.com

Difference between Capital and Assets Assets Vs Capital YouTube Is Capital Equipment An Asset capital assets (sometimes called fixed assets) are any significant pieces of equipment used for longer than a. capital assets are relevant properties of any kind owned by taxpayers, and they don't have to be attached to taxpayers' business or. generally classified by accountants as capital assets, capital equipment provides operating benefits over a sustained period. what. Is Capital Equipment An Asset.

From exolitjgf.blob.core.windows.net

Office Equipment An Asset Or Expense at Theresa Kirkland blog Is Capital Equipment An Asset generally classified by accountants as capital assets, capital equipment provides operating benefits over a sustained period. To be a capital asset, the. tangible capital assets are physical items that a business uses in its operations to produce goods or services. Companies are frequently investing in these items to. capital equipments are physical items acquired for a productive. Is Capital Equipment An Asset.

From www.investopedia.com

Capitalize What It Is and What It Means When a Cost Is Capitalized Is Capital Equipment An Asset capital assets are relevant properties of any kind owned by taxpayers, and they don't have to be attached to taxpayers' business or. Companies are frequently investing in these items to. generally classified by accountants as capital assets, capital equipment provides operating benefits over a sustained period. tangible capital assets are physical items that a business uses in. Is Capital Equipment An Asset.